Your current location is:Fxscam News > Foreign News

Tesla: Optimistic About Growth in the Chinese Market and Autonomous Driving Potential

Fxscam News2025-07-23 06:42:52【Foreign News】6People have watched

IntroductionWhat does yen mean,Foreign exchange app trading platform,Wedbush Analyst Strongly Supports Tesla, Maintains High Target PriceAmidst Tesla's ongoing deli

Wedbush Analyst Strongly Supports Tesla,What does yen mean Maintains High Target Price

Amidst Tesla's ongoing delivery struggles and CEO Musk's escalating conflict with Trump, longtime Tesla enthusiast and Wedbush's renowned analyst Dan Ives spoke out again in support of Tesla. In his latest report, Ives reaffirmed Tesla's "outperform" rating and maintained a $500 target price, demonstrating strong confidence in Tesla's long-term growth potential.

Recovery in Chinese Market Seen as "Heart and Lung" of Growth

Ives specifically pointed out that Tesla saw its first sales growth in China in eight months this June, highlighting the Chinese market as the "heart and lung" of Tesla's sales growth potential. Despite fierce competition within China and the ongoing entry of low-cost electric vehicles, Tesla has driven a recovery in sales through the upgrade cycle of the Model Y, boosting demand.

Ives expects that following the Model Y upgrade cycle, Tesla will see a significant delivery increase in the second half of 2025, accelerating overall growth.

Autonomous Driving Software Still Holds Disruptive Advantage

Ives stated that Tesla maintains a lead in the autonomous driving sector, with its software being "the biggest transformation" in the modern automotive industry. He noted that after Tesla's launch of FSD (Full Self-Driving) in Austin, it is positioned to dominate the U.S. market, with potential to license this technology globally, opening new avenues for profit growth.

Continued Sales Pressure: Cooling in European and American Markets

Despite optimism for long-term growth, Tesla's recent delivery data are less promising. The latest financial report shows that Tesla delivered 384,122 vehicles in Q2 2025, down 13% year-over-year, marking the second consecutive quarter of year-over-year decline. Concurrently, the European market remains sluggish, with Tesla's sales in the EU dropping 45% from January to May this year, and significant declines in Denmark, Sweden, and Germany.

Worsening Tensions Between Trump and Musk Raise Concerns

Aside from delivery challenges, the tension between Musk and Trump also raises market concerns. Trump recently threatened to investigate the government subsidies received by Musk's companies, including Tesla and SpaceX, which could affect policy support for Tesla's autonomous driving and new energy projects.

Ives expressed concern over this, suggesting that the feud between Musk and Trump might unsettle investors, with policy being crucial for Tesla's autonomous driving plans.

Diverging Investor Views But Confidence Remains

Prominent Tesla investor and CEO of Gerber Kawasaki Wealth and Investment Management, Ross Gerber, warned that the Musk-Trump conflict might impact Tesla's stock and create additional challenges.

However, Ives remains confident that Tesla will continue to lead in the global electric vehicle and autonomous driving markets, with the recovery of the Chinese market and advancements in autonomous driving technology being pivotal pillars for Tesla's future growth.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(79)

Related articles

- Yellow's bankruptcy is just the tip of the iceberg in the U.S. freight decline.

- XRP jumps 10.1%, hitting recent high and reshaping crypto market cap.

- Euro hits seven

- Fed hawkish comments push the dollar to a 10

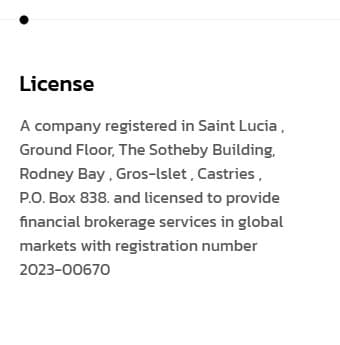

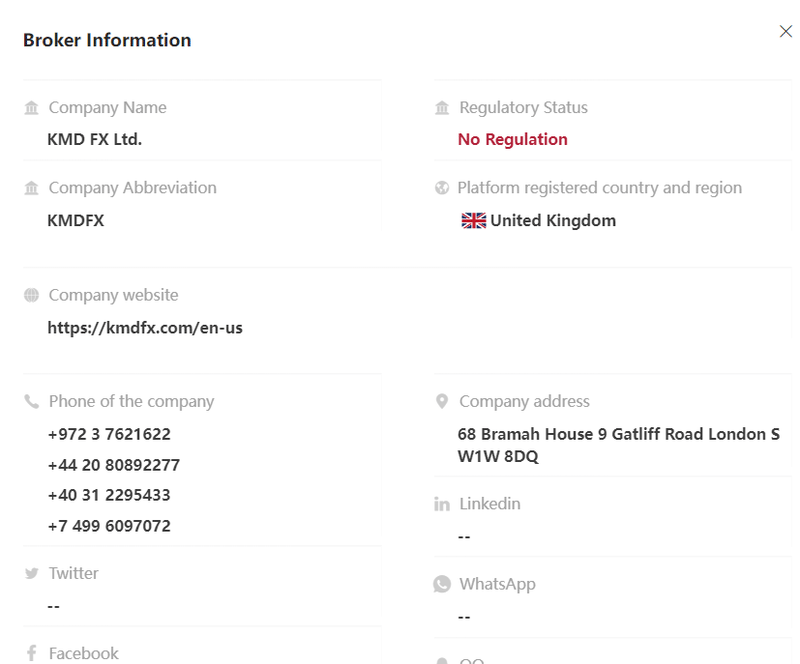

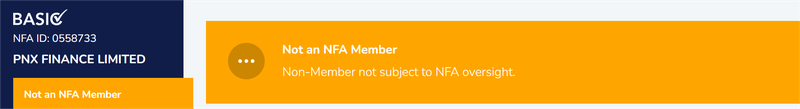

- Maono Global Markets broker evaluation:Illegal Operations

- Gold market cautious fluctuations: U.S. election deadlock, uncertainty supports gold prices

- Euro demand rises as global forex recovers, with 1.05 in investor focus.

- Musk backs Trump's Fed intervention, Middle East tension easing lifts market sentiment.

- Market Insights: Jan 9th, 2024

- Risk aversion boosts gold to a new high amid U.S. election disputes and Middle East conflicts.

Popular Articles

- Financial guru Mark Bouris criticizes Australia's real estate policies

- Trump victory expectations drive dollar up, causing forex market fluctuations.

- Australian dollar falls below key support amid global pressures and weak domestic data.

- The yen is under pressure; Japan may intervene for the first time in four months to support it.

Webmaster recommended

Market Insights: Mar 18, 2024

Weak U.S. manufacturing pressures Treasury yields, boosting gold's safe

Precious metals sentiment dips as palladium feels dollar and policy pressure.

Trump’s victory lifts the dollar, pushing spot gold to a three

Market Insights: April 18th, 2024

Gold surpasses $2,650, with predictions of a $3,000 milestone.

BOJ October minutes show internal split on timing of rate hike amid market volatility concerns.

Stronger USD pushes silver below $31; RSI below 40 signals continued bearish trend.